How Medicare Supplement Can Enhance Your Insurance Coverage Today

In today's facility landscape of insurance coverage alternatives, the function of Medicare supplements stands out as a crucial component in improving one's coverage. As individuals browse the complexities of medical care plans and seek thorough protection, comprehending the subtleties of supplemental insurance coverage comes to be progressively crucial. With a focus on connecting the spaces left by traditional Medicare plans, these extra alternatives offer a tailored strategy to meeting specific demands. By discovering the benefits, coverage choices, and expense factors to consider linked with Medicare supplements, people can make enlightened decisions that not only boost their insurance policy protection but likewise provide a complacency for the future.

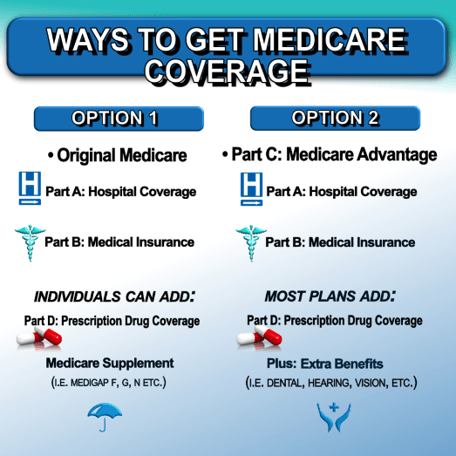

The Basics of Medicare Supplements

Medicare supplements, likewise called Medigap plans, supply additional insurance coverage to fill the spaces left by original Medicare. These supplementary plans are offered by private insurance provider and are designed to cover costs such as copayments, coinsurance, and deductibles that are not completely covered by Medicare Part A and Component B. It's crucial to note that Medigap plans can not be utilized as standalone plans yet job alongside initial Medicare.

One trick element of Medicare supplements is that they are standard across the majority of states, offering the same fundamental advantages no matter the insurance service provider. There are ten different Medigap plans identified A via N, each supplying a various degree of insurance coverage. Plan F is one of the most extensive choices, covering practically all out-of-pocket costs, while other plans may offer more minimal insurance coverage at a reduced premium.

Understanding the essentials of Medicare supplements is important for individuals approaching Medicare eligibility that desire to improve their insurance coverage and decrease potential economic problems related to healthcare expenditures.

Comprehending Protection Options

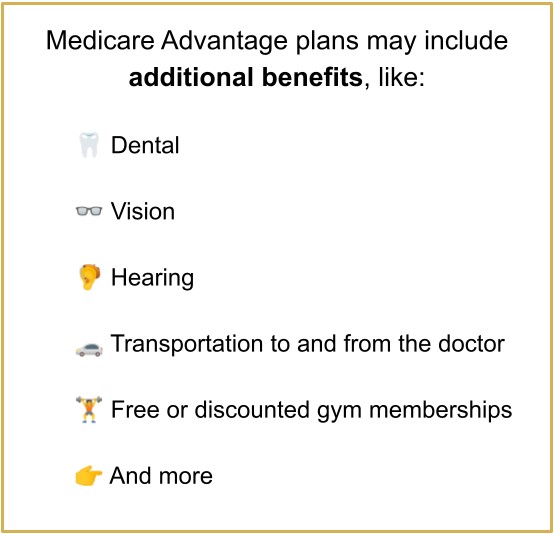

Discovering the diverse array of protection alternatives available can supply valuable understandings into supplementing medical care expenses successfully. When considering Medicare Supplement prepares, it is crucial to comprehend the various protection options to make sure comprehensive insurance coverage defense. Medicare Supplement plans, likewise called Medigap policies, are standard across a lot of states and classified with letters from A to N, each offering varying levels of protection. These plans cover copayments, coinsurance, and deductibles that Original Medicare does not totally pay for, offering recipients with economic safety and security and peace of mind. In addition, some strategies may offer insurance coverage for services not included in Original Medicare, such as emergency care during foreign travel. Comprehending the protection choices within each strategy kind is essential for individuals to choose a plan that lines up with their certain medical care demands and spending plan. By carefully evaluating the coverage options offered, beneficiaries can make educated decisions to enhance their insurance additional resources coverage and effectively manage healthcare costs.

Advantages of Supplemental Program

Additionally, extra strategies supply a broader range of coverage options, including access to medical care providers that might not approve Medicare assignment. One more benefit of additional strategies is the capacity to take a trip with peace of mind, as some plans use protection for emergency situation medical services while abroad. On the whole, the advantages of supplementary strategies add to a much more detailed and tailored method to health care insurance coverage, making certain that people can obtain the care they need without facing frustrating economic problems.

Cost Factors To Consider and Financial Savings

Provided the monetary safety and wider coverage alternatives given by supplementary strategies, a vital element to consider is the price factors to consider and potential financial savings they offer. While Medicare Supplement intends need a regular monthly costs along with the conventional Medicare Part B costs, the benefits of decreased out-of-pocket costs usually exceed the added cost. When assessing the price of extra plans, it is vital to compare costs, deductibles, copayments, and coinsurance across various plan kinds to identify one of the most economical choice based on private healthcare requirements.

Moreover, selecting a plan that lines up with one's health and monetary needs can lead to substantial cost savings with time. By choosing a Medicare Supplement strategy that covers a greater portion of medical care expenses, individuals can minimize unforeseen prices and budget a lot more effectively for healthcare. In addition, some additional strategies supply home discount rates or motivations for healthy behaviors, supplying more opportunities for expense financial savings. Medicare Supplement plans near me. Inevitably, purchasing a Medicare Supplement plan can provide useful economic protection and satisfaction for recipients looking for thorough insurance coverage.

Making the Right Option

Choosing the most suitable Medicare Supplement strategy demands mindful consideration of individual healthcare needs and financial circumstances. With a variety of strategies readily available, it is crucial to examine aspects such as protection choices, premiums, out-of-pocket prices, provider networks, and total worth. Comprehending your present health status and any kind of awaited medical needs can lead you in selecting a plan that offers detailed protection for services you may require. In addition, useful link reviewing your budget plan constraints and contrasting premium expenses among various plans can help make certain that you choose a strategy that is economical in the long term.

Conclusion